The Cost of Subjectivity: Why Accurate Risk Assessment Is Critical for Insurers

0 min

0 minRisk assessment in the insurance and reinsurance industry should be rational and objective. However, human biases, emotions, and subjectivity can unintentionally skew assessments, leading to inaccurate risk evaluations. This results in mispriced policies, inefficient capital allocation, and financial losses.

The challenge for insurance professionals—whether underwriters, portfolio managers, or risk engineers—is clear: How do we remove subjectivity and ensure that risk assessments are as precise and data-driven as possible?

Here’s how insurers and reinsurers can make sure their risk assessment remains objective:

1. Identify Critical Resources and Data

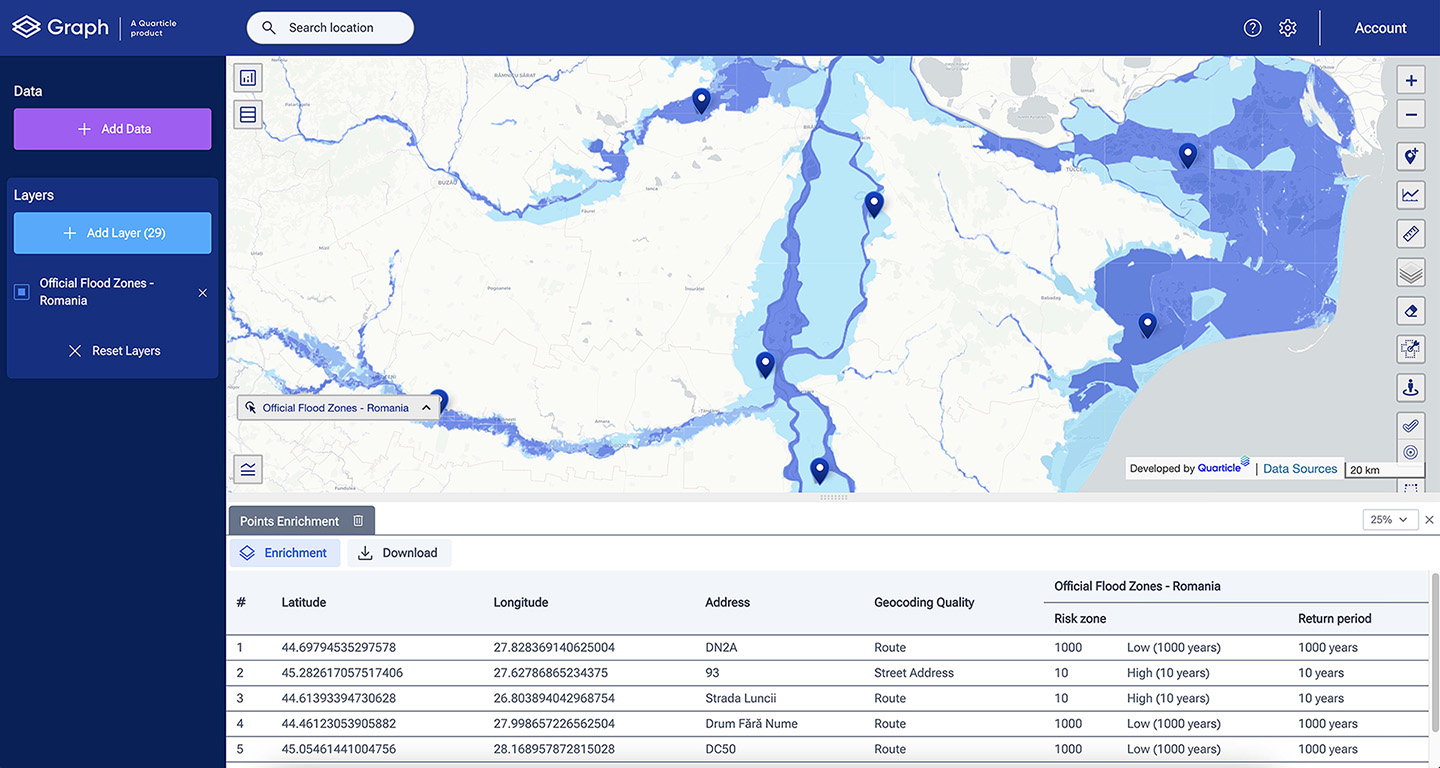

A precise risk assessment begins with defining what’s at stake. Insurers must determine which assets, properties, and regions are most exposed. This requires fast, real-time access to hazard layers, accumulation zones, and event footprints. Graph by Quarticle enables insurers to visualize these elements interactively, reducing uncertainty and increasing accuracy.

2. Assess the Potential Impact of Risks

Each identified risk must be quantified in financial terms. What would a flood, earthquake, or wildfire cost an insurer? What is the potential loss due to exposure concentration? With Qarta by Quarticle, insurers gain real-time risk data aggregation, allowing them to estimate financial impacts more accurately.

3. Define the Threat Landscape

The insurance industry faces various threats—climate change-induced weather events, geopolitical instability, and cyber risks. Not all of these threats apply equally across all insured assets. Through advanced geospatial modeling, insurers can filter out irrelevant threats and focus on high-impact risk factors.

4. Map Risks to Exposures

A risk is only meaningful when linked to an exposure. If a wildfire risk exists, but the insured properties in a region are fire-resistant, the actual exposure is lower. This is where accumulation control becomes critical. Solution providers today need to give insurers the option to overlay multiple data layers to have a clearer understanding of the risks that truly matter.

5. Evaluate Risk Exposure, Not Just Risk in Isolation

Raw risk data can be misleading. A low-frequency, high-impact event may seem threatening, but its probability must be weighed against potential losses. Insurance professionals need tools that calculate risk exposure dynamically, factoring in hazard intensity, historical loss data, and market trends. Graph’s high-performance analytics provide just that—an objective, scalable way to assess exposure without bias.

6. Aggregate and Standardize Risk Data for Better Decision-Making

Risk data must be standardized and structured for enterprise-wide decision-making. Insurers must be able to consolidate individual risk evaluations into portfolio-level insights. By integrating cloud-native solutions, insurers can streamline accumulation tracking and financial risk assessment without the friction of proprietary data restrictions.

Flood Hazard Analysis in Graph by Quarticle

The Role of Geospatial Intelligence in Objective Risk Assessment

Objectivity in risk assessment is only possible when decisions are based on reliable, standardized, and up-to-date data. The insurance industry must abandon manual assessments and embrace cutting-edge geospatial analytics that remove bias, improve risk selection, and enhance underwriting precision.

At Quarticle, geospatial intelligence plays a pivotal role in achieving objective, accurate, and scalable risk assessment. Our solutions are designed to enhance risk analytics by delivering high-performance, compliant, and open geospatial data processing. By leveraging real-time event footprints and high-performance risk analytics, we empower 12,000+ insurers to make data-driven decisions with confidence.

Want to learn more? Reach out at [email protected] or visit www.quarticle.ro to see how we can elevate your insurance operations.