Insurance Case Study | Accumulation Back-End API

The largest first insurer in the world reduced costs by 80% and drastically improved performance by replacing their existing GIS solution provider with the Qarta™ geo engine

“Quarticle’s geospatial intelligence platform allowed us to harmonize our application landscape. Finally, we can centrally manage all geospatial workflows and drive efficiency and effectiveness across our underwriting workflows. Providing our customers and brokers these significantly better and faster services not only saves operating costs, but also improves our underwriting decisions, and increases our margins – it allows us to provide the best-in-class experience to our users.”

Insurance Case Study | Accumulation Back-End API

Find out the full story

The Company

Our client is the largest first insurance company in the world with over 150,000 employees headquartered in Munich, Germany. As a market leader in the insurance, reinsurance, and asset management markets, they aim to help customers live with confidence and safety by offering high-quality solutions that exceed client expectations.

The Challenges

The client was experiencing significant problems with their former solution when it came to carrying out effective underwriting and accumulation control.

Additional challenges included:

- - Frequent outages, service unavailability and instability, and multiple failures generated by their previous GIS technology.

- - The speed of delivery was the crucial pain point - they had to wait for hours for an enrichment result

- - Extremely high costs without any scaling effects - their previous solution charged on a per-core basis, resulting in over-provisioning, maintenance, and higher costs overall.

All these challenges resulted in delays and frustration experienced by many stakeholders, inefficient work performed by underwriters, and missed business opportunities.

The Solution

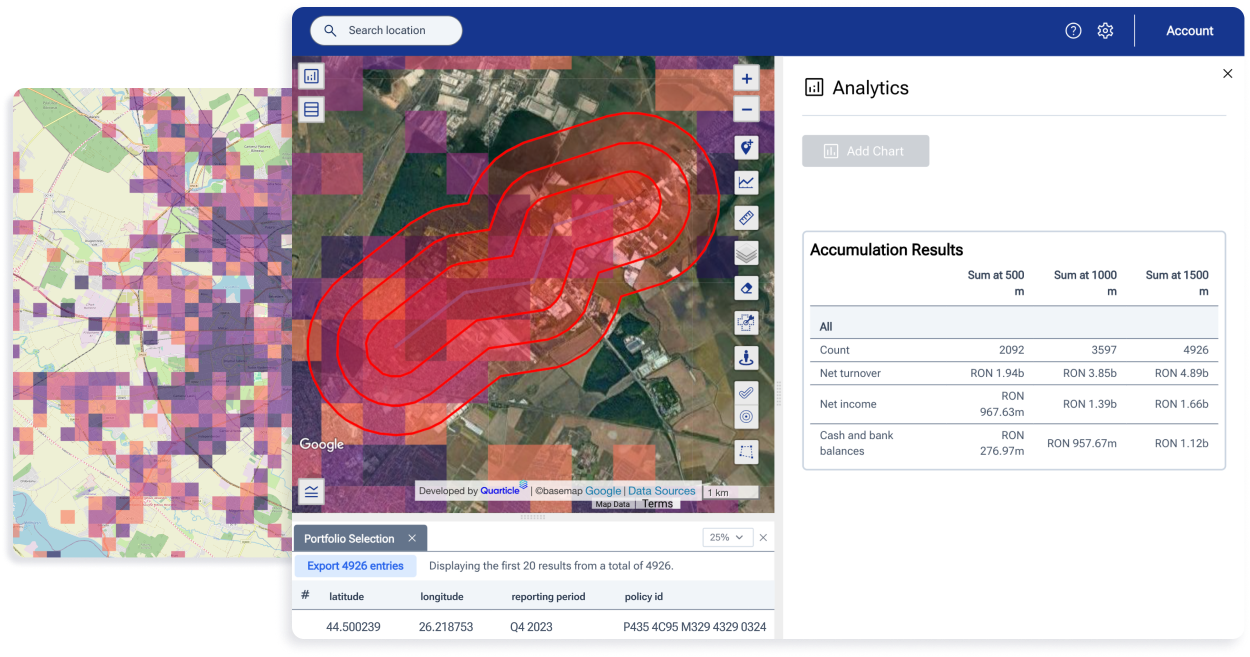

After carefully reviewing the client’s requirements, and architectural design principles, the full-blown migration and functional extension was initiated. The client replaced 170 servers with 1 server cluster due to Quarticle, improving operational efficiency and reducing hardware and operating costs.

Due to its automatic distribution of the workload through a load balancer to all available nodes, our solution (Qarta™) was not only faster process-wise, but it also provided a seamless experience for users, with full system stability, no outages, and no service unavailability. The solution created by Quarticle resulted in overall fewer missed business opportunities, no frustration, and clear and efficient usage by each stakeholder.

Quarticle offers a scalable and elastic pricing structure, resulting in a significant cost reduction for our client and giving them the flexibility to roll out the solution to multiple legal affiliates and their respective user base.

The Results

Quarticle provided an accumulation back-end API that was cloud-ready and enterprise-ready, served P&C risk models data to downstream systems with high efficiency and speed (22x faster in terms of requests per second than the previous solution) in the renewal season and supported monthly and quarterly business peaks on a Microsoft Azure flexible infrastructure. Costs were reduced by 80% with our consumption-based model.

The Quarticle team fully met their 6-month objectives and deadlines when working with the client who extended the partnership to a long-term commitment.